How to Unlock Funding to Invest in US Property

Opportunities take most people by surprise – they come at unexpected moments in equally unexpected ways.

Many end up seeing an opportunity as a risk rather than a chance for growth. They shun the idea of taking bold steps to grow their wealth, when in reality, these ‘risks’ can pave the way for their success.

During this pandemic alone, many people have lost hope in succeeding in their investments, putting all their plans on hold until this COVID nightmare lets up.

The thing is, nobody knows when that will be. There’s so much we’re missing out on while we’re busy entertaining our fears.

As mentioned in our last blog, it’s those who learn to change their mindset who can overcome any obstacle. And while that’s a huge leap in welcoming opportunities and taking them, people often find themselves stuck deep in a new problem: they’re credit frozen.

So how do you invest in property when your bank account isn’t ready?

If dealing with being fear frozen means improving your mindset, overcoming credit freeze means improving your skill set.

Skill Sets and How They Benefit Property Investing

According to The Balance Careers, a skill set is “the combination of knowledge, personal qualities, and abilities you’ve developed through life and work.”

In other words, a skill set is applied knowledge you learn through studies and experience, which you usually become good at with repeated practice.

All skills can be categorised in two major skill types:

- Soft skills. These are interpersonal skills like communication, leadership, teamwork, critical thinking, and empathy. The more soft skills you have, the better you are at relating and working with other people. Most soft skills are important and applicable in any kind of job or investment.

- Hard skills. These are technical skills and field knowledge more specialised based on the type of job or investment you’re pursuing (e.g. IT professionals should have programming skills, chefs should have cooking skills, etc.)

When investing in property, especially in the US, there’s a wide range of skills every investor should have. Including:

- Strategic planning skills to create the best strategies in each of your investments

- Critical-thinking skills for every crucial investment decision

- Leadership skills to lead your on-ground team in the US

- Communication skills to have good and clear relations with your on-ground team and to better understand your tenants’ behaviour or demands

- Research and analysis skills for studying the US property market, understanding cash flow and risks, and finding the perfect location to invest

- Finance skills to stay on top of your finances and determine whether you’re reaching your target ROI

- Time management skills to have a healthy work-investment life balance

- Patience and persistence to always continue learning and improving

- Sales and negotiation skills to get better deals for the property you want to buy and attract potential tenants (in case you want to sell the property yourself)

Without these skills, you’ll find yourself feeling lost on how to get your investment right. But the good thing about skill sets is they can be taught, and therefore learned.

If you’re a beginner at investing in US property, start learning these skills and you’ll be well on your way to a successful property investment journey.

3 New Skills for Property Investing

Skills can be learned through studies, experience, and practice. To gain these new skills and excel at performing them, here are three steps for you to follow:

- Do your research

The first thing you have to do is to research the particular skill set you want to learn. You need to understand what you’re getting into to get an idea of how you’re going to do it.

For example, if you want to invest in property but don’t know anything about creating a good strategy, the first thing you should do is to read up on how to build a strategy that works. Study different strategies different investors have tested and understand the concepts behind them.

- Try it out

You know all about the skill through research and you might think that’s enough, but remember theoretical scenarios are often different from actual ones.

You might memorise concepts by heart, but you won’t truly learn a skill unless you do it yourself.

You’ve read plenty of books about building a strategy that works but you’re still not skilled in strategising yet unless you have actually created a strategy, applied it, and reaped positive results.

- Rinse and repeat

As the saying goes, “Practice makes perfect.”

Being good at creating strategies means your strategies will work all the time. If something is amiss, change it and improve next time. Note what works and what doesn’t.

All this practice will help you understand the ins and outs of a skill, and if you keep getting it right, you’ll become an expert.

In many cases, self-learning caps a person’s skill level because they can only work on what they know. This is why things like mentorship are extremely valuable in learning new skill sets.

Previously we talked about the importance of coaching and training in taking the right steps in your investment, which will lead you to impressive ROIs.

3 Ways to Unlock Funding for US Property Investment

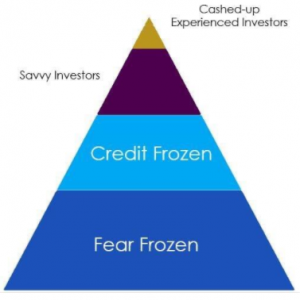

Recently, we talked about the investment hierarchy, which shows the progression of an investor before they become well-experienced and successful.

As the hierarchy shows, you can only become a savvy investor if you surpass the tier of being credit frozen (assuming you’ve already overcome the fear of taking opportunities when they knock on your door).

Being credit frozen means you don’t have sufficient funds to invest in property. Without enough funds, you can’t start investing unless you get a pay raise, a new job, or a new stream of income and take the time to save up, right?

This is one of the few times you’ll be glad to be wrong.

There are many approaches you can take to access funds and embark on your investment journey as soon as the opportunity arises. You just need to have the necessary skill sets to understand them.

Here are three ways you can apply your skills to unlock funding for US property investment:

Joint-Venture

If you have a wealth of knowledge about real estate or property management but don’t have enough cash flow or assets to enter the property market, you’ll be happy to know your skill set can still allow you to invest in property.

All it takes is to find your “other half” of the equation and start a joint-venture.

A joint-venture is a deal between two parties (you and a friend, relative, property owner, or contractor) to combine resources and invest in property together, sharing the net profit.

Typically, how this works is the first investor will contribute funds and cash flow to buy property (under their name only), renovate, and sell for a profit.

Your contribution as the second investor is your skills in identifying the right property, handling the renovation, and managing the sale for a profit.

When the property is sold, the first investor will be repaid for their initial and continuing contribution, and the balance or rental received from the property will be split between the both of you.

While that’s a typical method, especially if the first investor is a family member, there are also many other ways to work as a joint-venture. Ultimately, it all depends on your agreement with your joint-venture partner.

The key is to pool your available resources, split the financial contributions, and profit accordingly.

For example, if you’re partnering with a friend, each of you can contribute 50% of all expenses, and therefore divide the net profit 50-50. If you’re partnering with a property owner, you can offer to contribute funds for the renovation and help put the property back on the market, where you can get a fair percentage of the profit.

Land Contracts

According to Investopedia, a land contract is an agreement between a buyer and seller about a specific tract of land and is often structured with seller financing.

With a land contract, the buyer gets immediate access to the property while paying the seller over a period of time instead of doing one up-front payment. Normally, the seller retains the title of the property until the buyer pays off most or all of the remainder of the price.

So let’s say there’s a property up for sale worth $50,000. If the owner is offering or willing to sell on a land contract, you can pay $20,000 up-front and pay the rest over the next 12 months.

In those 12 months, you can get the property renovated, sell it, and use the money to pay off your balance while still gaining profit.

You can also sell properties on land contracts and earn more than your selling price through interest from 5-10%.

Private Equity (Hard Money)

Investopedia defines private equity as “an alternative form of private financing, away from public markets, in which funds and investors directly invest in companies or engage in buyouts of such companies.”

This is a huge market in the US and a considerable percentage of it is available for foreign investors. They’re not looking for someone with high income and you don’t need to have security as the security is on the property you’re purchasing.

Private equities have more flexible loan options and less stringent requirements, making them a great funding alternative for property investors.

Private equity firms can give you about 65-70% of the purchase price and fund up to 100% of the renovation costs as long as it meets certain criteria (e.g. the property should be worth a minimum of $100,000 when it’s finished). So you need to make sure you know things like the exact types of properties they lend on and the regions they lend in.

Becoming a cashed-up experienced investor doesn’t happen overnight. There are phases that most, if not all investors go through.

The best investment opportunities come when you least expect them, so you must be prepared to take them and be well-equipped for your success.

This means having the right mindset getting you past the fear frozen phase many aspiring investors get trapped in. This also means having the right skill sets helping you access funds to get a head start in property investment when you’re credit-frozen.

If you want to learn more about how to get into the lucrative U.S Property market, please book a call with us as we’re happy to share our knowledge with you.